Forex Trading Online Broker: Your Guide to Successful Trading

Forex trading has become an incredibly popular investment avenue in recent years, with the advent of online platforms that allow traders to engage in currency exchange from the comfort of their homes. For both novice and seasoned traders, finding a reliable forex trading online broker India Brokers is crucial for navigating this complex market effectively. This article aims to provide insights into what Forex trading is, how online brokers operate, and key factors to consider when selecting the right broker for your trading needs.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market in the world, with daily trading volumes exceeding $6 trillion. It involves the buying and selling of different currencies, which are traded in pairs – for example, the EUR/USD or the GBP/JPY. Unlike other financial markets, the Forex market operates 24 hours a day, five days a week, allowing for high liquidity and diverse trading opportunities.

The primary reason traders engage in Forex trading is to profit from the fluctuations in currency exchange rates. These fluctuations can be influenced by various factors, including economic indicators, geopolitical events, and market sentiment. As such, Forex trading requires a good understanding of market dynamics and a strategic approach to trading.

Role of Online Brokers

Online brokers serve as intermediaries between traders and the Forex market. They provide the trading platform, tools, and resources necessary for executing trades effectively. While selecting a broker, it’s vital to consider aspects like regulation, fees, customer support, trading platform features, and available currency pairs.

Most brokers offer a demo account, allowing traders to practice trading with virtual money before risking real funds. This feature is particularly beneficial for beginners who want to familiarize themselves with the trading environment and the broker’s platform.

Key Features to Look for in a Forex Broker

1. Regulation and Safety

One of the main factors to consider when choosing a Forex broker is regulation. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders from fraud. Examples of regulatory bodies include the Commodity Futures Trading Commission (CFTC) in the USA, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

2. Trading Costs

Different brokers have varying fee structures. It is crucial to understand the costs associated with trading, including spreads, commissions, and overnight fees. Low trading costs can significantly affect profit margins, especially for high-frequency traders.

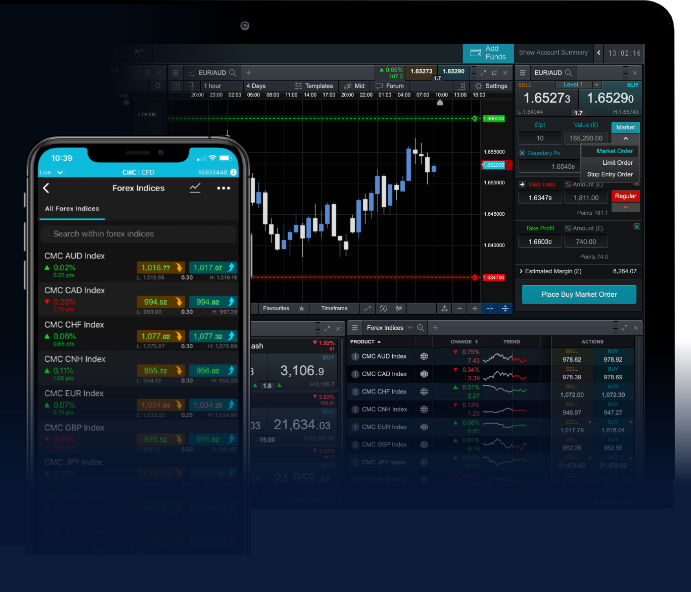

3. Trading Platform

Having a stable and efficient trading platform is essential for seamless trading. Look for brokers that offer user-friendly interfaces, a range of technical analysis tools, and the ability to execute trades quickly. Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

4. Customer Support

Good customer support is crucial, especially when you encounter issues while trading. Check for available support channels, including live chat, email, and phone support. Additionally, consider the support hours – ideally, they should align with your trading hours.

5. Range of Currency Pairs

Depending on your trading strategy, you may want access to a wide range of currency pairs. While all brokers provide major currency pairs, not all offer the same depth of minor or exotic pairs, which may be essential for specific trading strategies.

Educating Yourself and Developing Strategies

While choosing the right broker is crucial, your success in Forex trading hinges on your knowledge and strategies. There are numerous educational resources available, including online courses, webinars, and trading articles.

It’s advisable to develop a solid trading plan that outlines your risk tolerance, trading style, and goals. Some traders prefer day trading, while others adopt a long-term approach. Each style requires different strategies, risk management techniques, and time commitments.

Technical analysis, which involves analyzing price movements and chart patterns, is fundamental in Forex trading. Many traders also use fundamental analysis, which looks at economic indicators and news events that can influence currency values.

Common Mistakes to Avoid

Even the most experienced traders make mistakes. Here are some common pitfalls to avoid:

- Lack of a Trading Plan: Trading without a plan can lead to impulsive decisions and significant losses.

- Overleveraging: Using too much leverage can amplify losses, so it’s essential to manage your leverage appropriately.

- Ignoring Risk Management: Successful trading requires effective risk management strategies, such as using stop-loss orders.

- Chasing Losses: Trying to recover losses with hasty trades often leads to further losses.

Conclusion

In conclusion, Forex trading through an online broker offers exciting opportunities for profit, but it comes with inherent risks. By thoroughly researching and selecting a reliable broker, educating yourself on trading strategies, and adhering to a disciplined trading plan, you can enhance your chances of success in the Forex market. Whether you are a beginner or an experienced trader, understanding the critical elements of Forex trading is essential to navigating this dynamic financial landscape.